- Guideline on Issue of ESG Bonds

- The issuance structure of ESG bonds is in the following diagram. ESG bonds are the same as other bonds from a financial perspective, such as bond issuance and repayment of principal. One of the differences is that, unlike other bonds, ESG bonds formulate an ESG bond framework, which an external institution will review to examine if the framework is aligned with the principles. Another difference is that, once the bonds are issued, ESG bonds are required to perform regular reporting at least once a year. In terms of Green/Social/Sustainability bonds, the reporting should include current proceeds used and environmental/social improvements they have achieved. In terms of Sustainability-Linked bond, the reporting should include the SPT achievements.

- ESG Bond Management Framework

- The framework elements

- Green, Social, Sustainability Bonds : 1) Use of Proceeds, 2) Process for Project Evaluation & Selection, 3) Management of Proceeds, and 4) Reporting

- Sustainability-Linked Bond : 1) KPI, 2) SPT, 3) Characteristics of Bond, 4) Reporting, and 5) Verification

- External Review

- This is to ensure that the ESG bond management framework is aligned with the applicable principles or standards such as the GBP, CBS, SBP, Sustainability Bond Guidelines, SLBP, etc.

- Reporting

- Regular reporting elements

- Green, Social, Sustainability Bonds : the use of proceeds and environmental & social impact of bond issuance

- Sustainability-Linked Bond : determination of SPT achievements

- Structure of a ESG Bond Issue(Green bond, Social bond and Sustainability bond)

<Comparison between Issue of ESG bonds and Ordinary (Non-ESG) Bonds>

<K-Green Bond Issuance Structure>

- Process to register bonds in the ESG dedicated Data Platform of the KRX

-

- Check if the following eligibility criteria set by the KRX are met:

-

※ Criteria for the ESG dedicated Data Platform of KRX (Article 4 of「Guidelines for Operation fo ESG Bond Information Platform」)

- 1. The debt securities must be listed on the securities market operated by KRX.

- 2. The debt securities must be in line with the following ESG bond principles.

-

- Green bond : FSC & ME 「Korea - Green Bond Guidelines」, ICMA 「Green Bond Principles」, CBI 「Climate Bond Standard」 or Other Principles acceptable to KRX

- Social bond : ICMA 「Social Bond Principles」 or Other Principles acceptable to KRX

- Sustainability bond : ICMA 「Sustainability Bond Guidelines」 or Other Principles acceptable to KRX

- Sustainability-Linked bond : ICMA 「Sustainability-Linked Bond Principles」 or Other Principles acceptable to KRX

-

- Submit application forms and other required documents

- KRX reviews the eligibility and decides whether to accept the application or not

- KRX notifies the decision

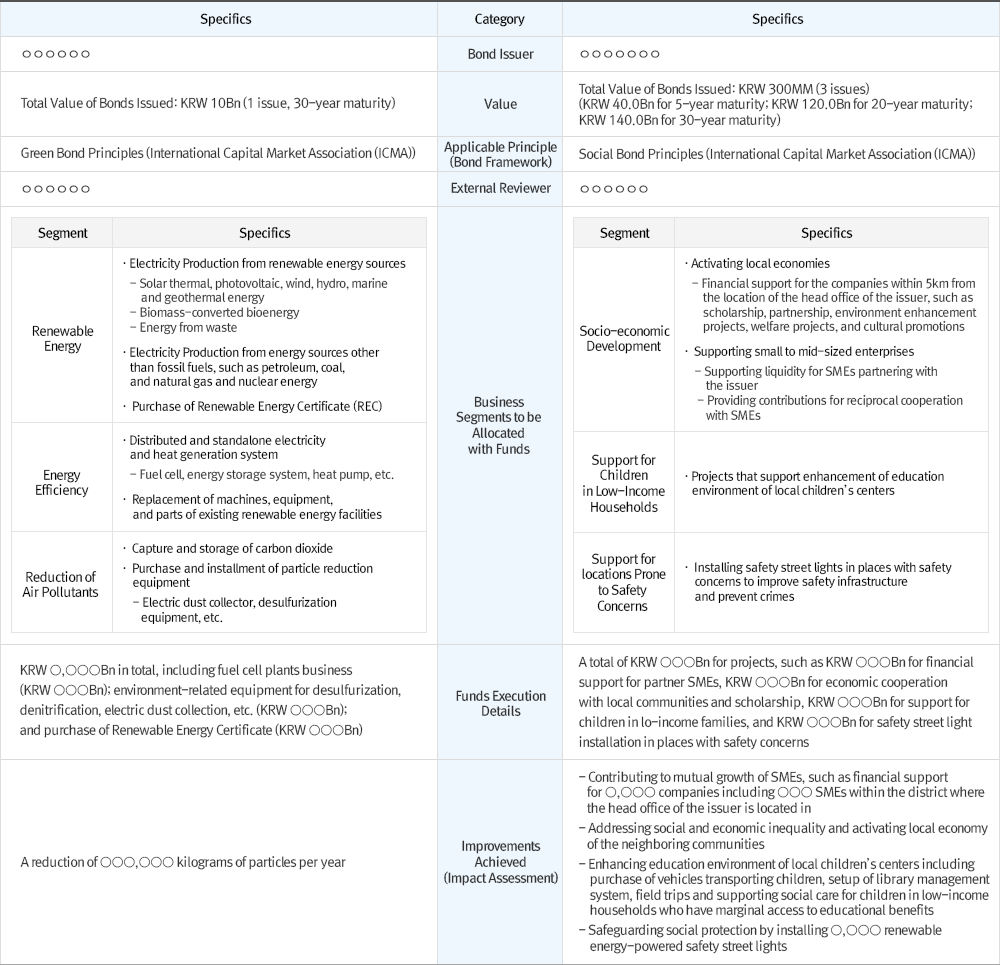

- Examples of a Bond Issue